110

Unit 2 Money and Regulation

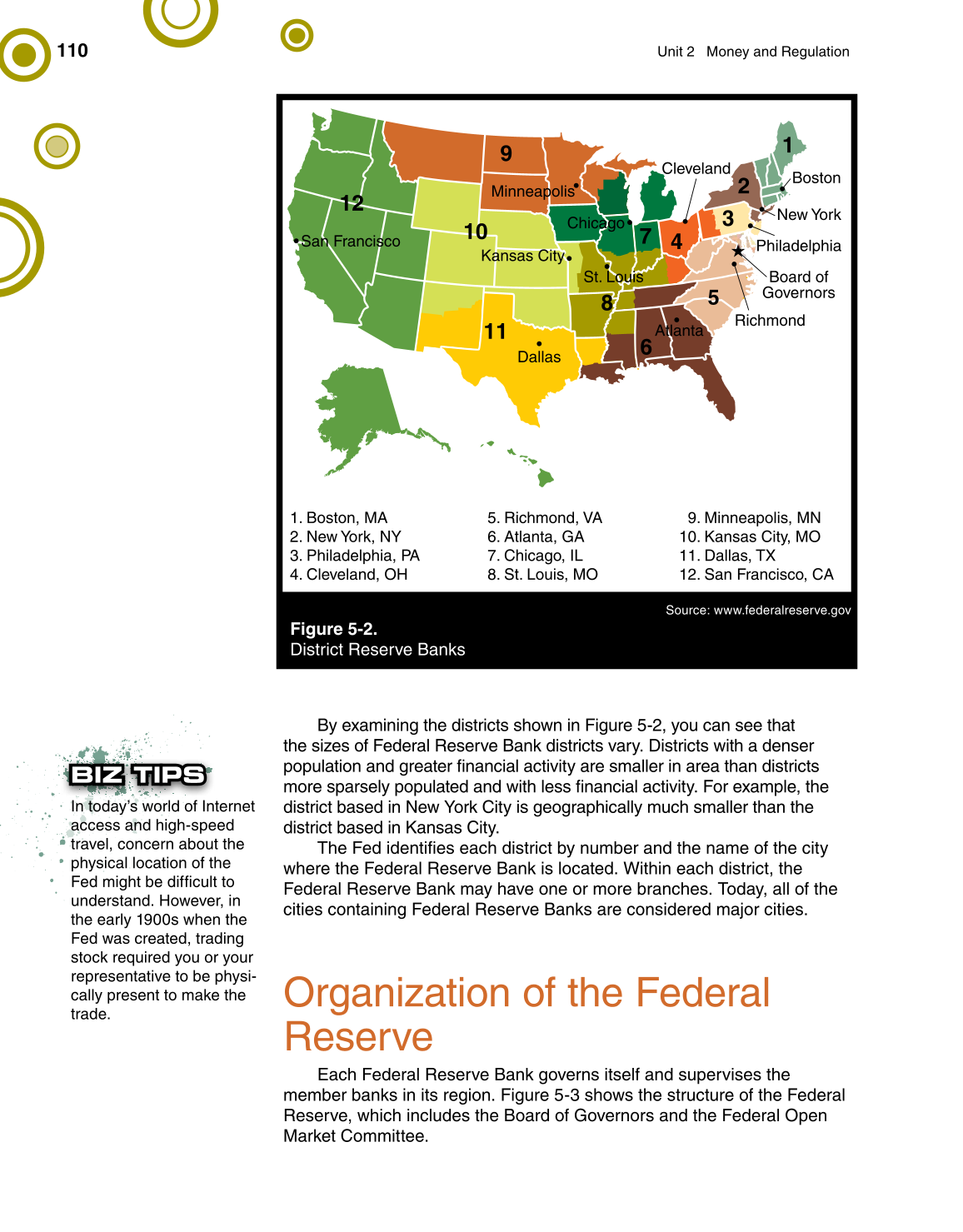

Axdw‘lhmhmfsgdchrsqhbsrrgnvmhmEhftqd4,1+xntb‘mrddsg‘s

sgdrhydrneEdcdq‘kQdrdqudA‘mjchrsqhbsru‘qx-Chrsqhbsrvhsg‘cdmrdq

onotk‘shnm‘mcfqd‘sdq›m‘mbh‘k‘bshuhsx‘qdrl‘kkdqhm‘qd‘sg‘mchrsqhbsr

lnqdro‘qrdkxonotk‘sdc‘mcvhsgkdrr›m‘mbh‘k‘bshuhsx-Enqdw‘lokd+sgd

district based in New York City is geographically much smaller than the

district based in Kansas City.

SgdEdchcdmsh›drd‘bgchrsqhbsaxmtladq‘mcsgdm‘ldnesgdbhsx

where the Federal Reserve Bank is located. Within each district, the

Federal Reserve Bank may have one or more branches. Today, all of the

cities containing Federal Reserve Banks are considered major cities.

Organization of the Federal

Reserve

Each Federal Reserve Bank governs itself and supervises the

member banks in its region. Figure 5-3 shows the structure of the Federal

Reserve, which includes the Board of Governors and the Federal Open

Market Committee.

5

12

9

10

11

7

8

6

4

3

2

1

Minneapolis

San Francisco

Dallas

Kansas City

St. Louis

Chicago

Atlanta

Cleveland

Richmond

Boston

New York

Philadelphia

Board of

Governors

1. Boston, MA

2. New York, NY

3. Philadelphia, PA

4. Cleveland, OH

5. Richmond, VA

6. Atlanta, GA

7. Chicago, IL

8. St. Louis, MO

9. Minneapolis, MN

10. Kansas City, MO

11. Dallas, TX

12. San Francisco, CA

Source: www.federalreserve.gov

Figure 5-2.

ChrsqhbsQdrdqudA‘mjr

BIZ TIPS

Hmsnc‘xvnqkcneHmsdqmds

access and high-speed

travel, concern about the

physical location of the

Edclhfgsadche›btkssn

understand. However, in

the early 1900s when the

Fed was created, trading

stock required you or your

representative to be physi-

cally present to make the

trade.