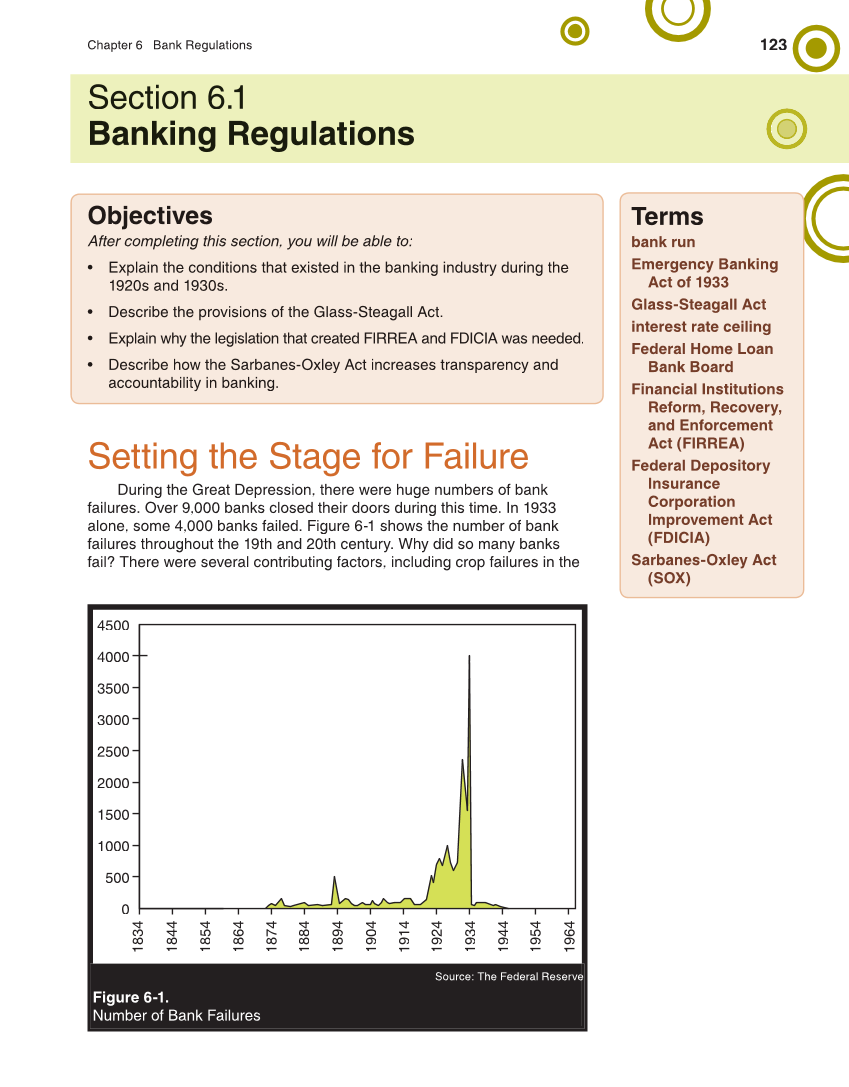

123 Chapter 6 Bank Regulations Section 6.1 Banking Regulations Objectives After completing this section, you will be able to: • Explain the conditions that existed in the banking industry during the 1920s and 1930s. • Describe the provisions of the Glass-Steagall Act. • Explain why the legislation that created FIRREA and FDICIA was needed. • Describe how the Sarbanes-Oxley Act increases transparency and accountability in banking. Setting the Stage for Failure During the Great Depression, there were huge numbers of bank failures. Over 9,000 banks closed their doors during this time. In 1933 alone, some 4,000 banks failed. Figure 6-1 shows the number of bank failures throughout the 19th and 20th century. Why did so many banks fail? There were several contributing factors, including crop failures in the Terms bank run Emergency Banking Act of 1933 Glass-Steagall Act interest rate ceiling Federal Home Loan Bank Board Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA) Federal Depository Insurance Corporation Improvement Act (FDICIA) Sarbanes-Oxley Act (SOX) 0 500 1000 1500 2000 2500 3000 3500 4000 1 834 1844 18 5 4 1864 18 7 4 1884 1894 1904 1 9 1 4 1924 1934 1944 1954 1 964 4500 Source: The Federal Reserve Figure 6-1. Number of Bank Failures