34 34

Section 2.1

Your Personal Financial Landscape

Objectives

After studying this section, you will be able to:

¶ Khrs‘mccdrbqhadsgdrsdorhml‘m‘fhmfxntqlnmdxsgqntfgsgd

planning and creation of a budget.

¶ Dwok‘hmgnvsnbqd‘sd‘b‘rgeknvrs‘sdldms-

¶ Dwok‘hmgnvsnbqd‘sd‘mdsvnqsgrs‘sdldms-

Terms

budget

income

dwodmrd

ehwdcdwodmrd

u‘qh‘akddwodmrd

chrbqdshnm‘qxdwodmrd

philanthropy

cash flow statement

net worth statement

net worth

asset

liability

wealth

Budgets

In Chapter 1, you learned about the importance of financial planning.

Planning allows you to meet changing needs and goals over your lifetime. It

adfhmrvhsgl‘m‘fhmfc‘hkxdwodmrdr-@atcfdsb‘mgdkoxntl‘jdsgdlnrs

of your money and avoid financial problems.

A budgethr‘ok‘menqsgdtrdnelnmdxnudqshlda‘rdcnmfn‘kr+dwodmrdr+

‘mcdwodbsdchmbnld-Hshrsgdsnnksg‘skdsrxnts‘jdbnmsqnknexntqehm‘mbdr-

Planning helps you meet daily needs and achieve your future goals as well.

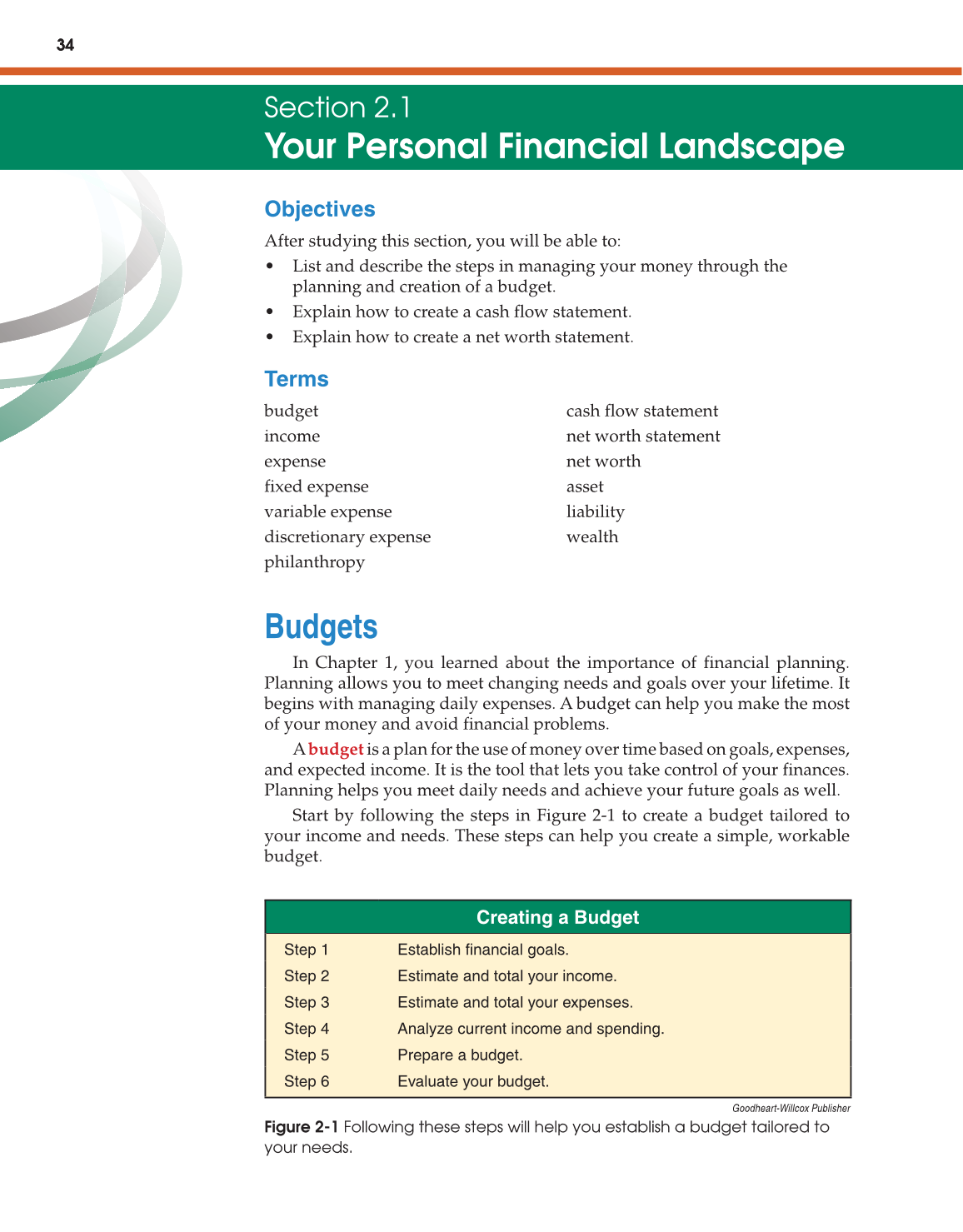

Start by following the steps in Figure 2-1 to create a budget tailored to

your income and needs. These steps can help you create a simple, workable

budget.

Creating a Budget

Step 1 Establish financial goals.

Step 2 Estimate and total your income.

Step 3 Estimate and total your expenses.

Step 4 Analyze current income and spending.

Step 5 Prepare a budget.

Step 6 Evaluate your budget.

Goodheart-Willcox Publisher

Figure 2-1 Following these steps will help you establish a budget tailored to

your needs.